In the fast-paced financial advisory industry rife with technological shifts and burgeoning regulatory complexity, firms face mounting infrastructure and administrative demands, pulling focus from core investment advisory services best aligning unique expertise. Recognizing excessive operational scope creep risks, many advisors now streamline capabilities by strategically outsourcing non-core functions to specialist partners – optimizing efficiencies and compounding competitive performance continuity. This piece examines four outsourcing approaches to securing advisory futures amid intensifying industry disruptions.

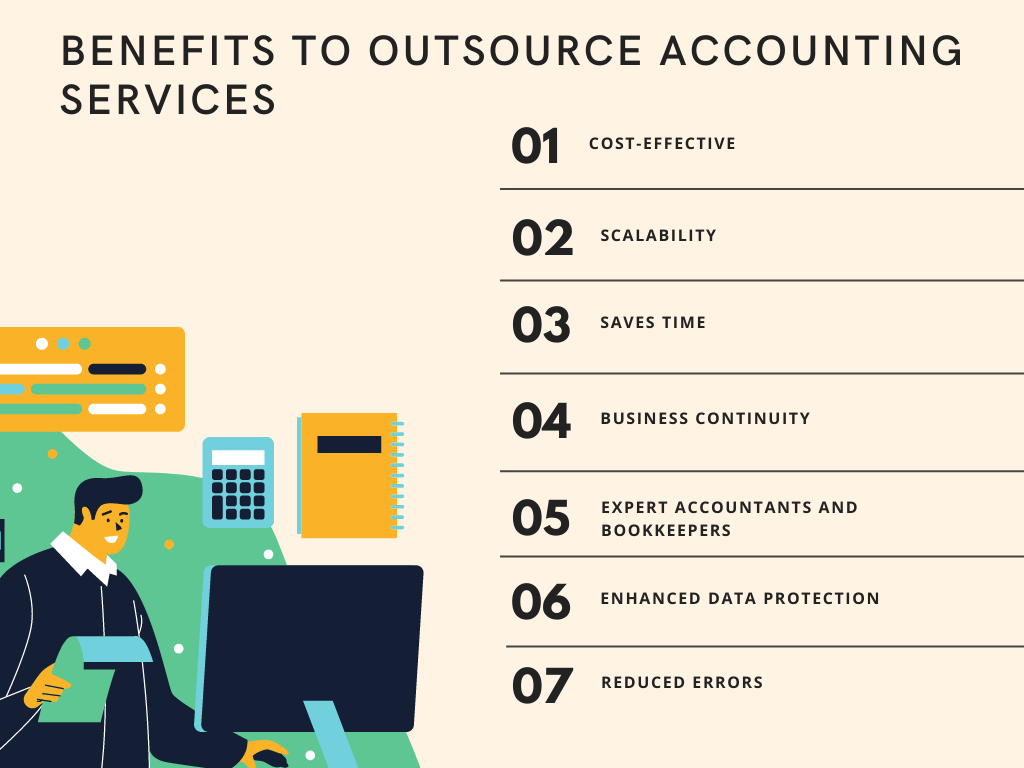

In the current dynamic financial advisory landscape, there’s a compelling need to prioritize activities that uniquely drive value, with a focus on leveraging the capabilities of internal talent for optimal results. By outsourcing time-consuming non-core responsibilities to trusted specialists, advisory firms regain precious bandwidth by realigning around client service and investment selection excellence, lifting performance trajectories, and setting industry pacesetters apart sustainably when supported robustly behind the scenes.

Key Insight: Technology and IT infrastructure outsourcing

As digital security risks accelerate alongside near-daily technological shifts pervading client experiences today, most advisory firms struggle internally to resource complete IT teams, securing stability with the same rigor. Fortune 500 corporations implement strategies to protect against vulnerabilities and enhance responsiveness, both essential for maintaining 24/7 round-the-clock accessibility and meeting client service expectations consistently.

Fully managed solutions provided by specialists deploy enterprise-grade cybersecurity, cloud reliability enforcements, and help desk responsiveness matching scales and urgency client-facing advisory firms, which are now required competitively. Proactive support prevents outages and data breaches threatening continuity gravely.

Strategic RIA business continuity plans ensure operational security through a system of layered detection protocols designed to promptly identify potential threats, employ multi-channel data redundancy backups for external storage of critical materials, and implement rapid failover measures capable of activation within hours. This keeps firms functioning smoothly through most crises. Expert IT partners protect futures, liberating advisors continuously.

Key Insight: Administrative Tasks Outsourcing

As compliance rulebooks thicken and form requirements systematize, advisors spend inordinate hours weekly manually executing administrative workflows, which are distraction-prone. They then return focus to the sophisticated advisory duties core to securing competitive positioning through market volatility. Reporting needs to be standardized amidst these challenges. The present-day’s rapidly changing equities environments are hindered in their strategic readiness due to manual inefficiencies in taxation and systems.

Everyday items transitioned successfully include scanning and digitization projects securing data continuity assurances moving forward, customer billing and invoicing generation ensuring timely accuracy processing, regulatory filings, and license renewals upholding compliance confidence across evolving jurisdictions advisory purview expands toward additionally over time. Check recurring bottlenecks hampering focus.

Delegating routine documentation, taxation, payment and fees management, form processing, and even mail handling tasks to dedicated operations teams brings fresh accuracy and productivity. Outsourcing streamlined workflows promoting quality and consistency through specialty task-focus.

Key Insight: Customer Service and Support

Positive customer experiences today make or break advisory firm reputations, rapidly relayed online through reviews or social channels instantly. Yet fluctuating inquiry volumes around tax seasons, market volatility spikes, or general service needs risk inconsistent experiences periodically stretching internally trained teams thin. Expert outsourced assistance profoundly prevents such deficiencies.

Expanding help desk capabilities through specialized teams and upholding customer service etiquette standards similar to advisory expectations provide supplementary assistance, avoiding hold times and escalating frustration during peak inquiry months. Customers appreciate consistently smooth access, upholding experiential continuity expected from advisory firm associations. Reliability matters most strengthening retention mutually long term.

Key Insight: Investment Research and Analysis Outsourcing

While generating informed investment research and strategy analysis represents critical advisory value drivers, comprehensive coverage across exponentially expanding global markets and asset classes spreads even large research teams with limited hours daily produce uniquely. Supplemental research underpins advice resonance always.

Tasks outsourced include proprietary investment signal consolidation from dispersed fund reports into unified recommendations dashboards, in-depth due diligence evaluations on prospective asset inclusion for client portfolios, and customized capital projection modeling assessing likelihood target return scenarios to inform advisory planning needs continually.

Wrap-Up

In summary, outsourcing critical non-core capability supplementary responsibilities to specialist teams allows financial advisory firms to focus accurately on delivering client investment excellence and high-touch services, sustaining enterprise growth continually without unnecessary distractions hampering progress. The benefits of sharpened efficiencies and risk mitigation support firms in the long term. Identify overloaded areas and activate reliable partner assistance to secure your advisory future.